What is Compound Interest?

Put simply, compound interest is the earning of interest upon already existing interest.

For example, you have £50 in a savings account, earning interest at a 10% rate, compounded annually. At the end of the first year, you’d have £55 (50 in principal + 5 in interest). At the end of the second year, you’d have £60.50 (55 in principal + 5.50 in interest). Ending the third year, you’d have £66.55 (60.50 in principal + 6.05 in interest). This is how compound interest works.

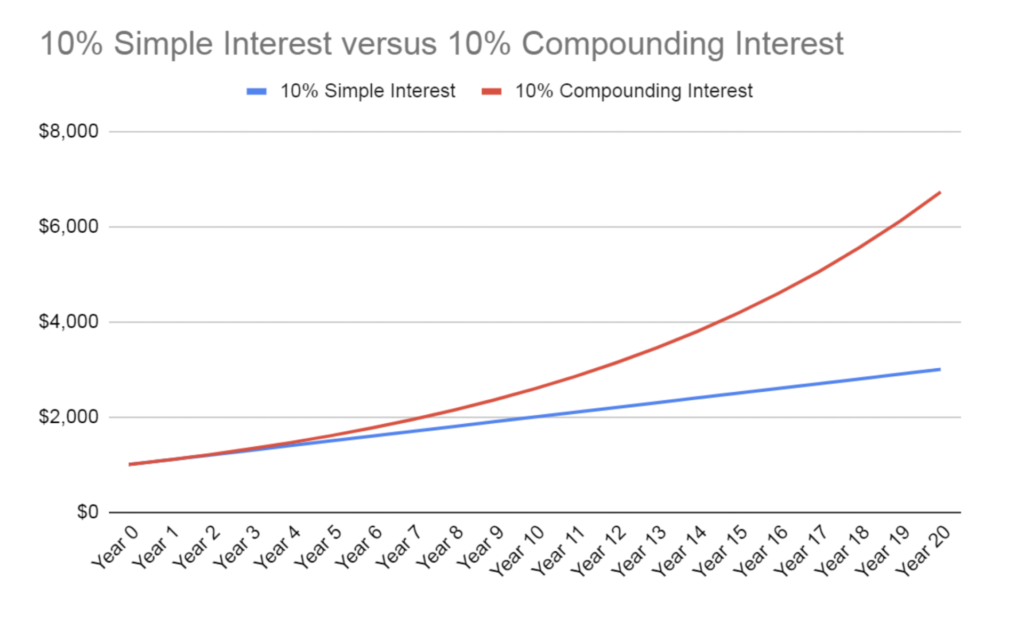

Simple vs. Compound interest

Unlike compound interest, simple interest doesn’t earn interest upon interest. If you invest the principal amount of £50 at 10%, you will only earn interest on the principal amount (£5 interest per year). You will see linear growth in your savings with simple interest, whereas compound interest has a ‘snowball effect’ where over time, money grows at an exponential rate.

How can yacht crew utilise interest?

Due to the high earnings of yacht crew, they can invest a larger amount than most. Investing more will lead to a much higher return. This is all money that can be saved to secure your financial stability after leaving the yachting industry.

Fixed-rate ISAs can provide good interest (generally the longer you are willing to tie your money up, the higher the interest rate). Also, make sure to consider assets like stocks, mutual funds, and ETFs. These will also gain interest.

The importance of a financial advisor

Whilst it’s a good idea for yacht crew to be knowledgeable of their finances, investing your money can be a minefield. This is why professional financial advice can be of huge benefit. At CrewFo, we are here to help yacht crew look after their savings by demystifying the process of investing.

If you’re wanting to reap the benefits of compound interest, we are here to talk through your options.

Stop by the crew mess for more tips on managing your money.

.gif)

.gif)