With unprecedented levels of stock market volatility at the start of the year thanks to COVID-19, where are we now halfway through 2020? What are the investment opportunities and threats to investors?

In this guest piece for Superyacht Content, Church House Investments take a look at how crew can make the most of their cash, assessing:

1) Equities (shares) versus cash – which has performed better?

2) The impending threat of inflation – what is it and why is it relevant to you?

3) The benefits of a liquid and diversified portfolio of investments

4) Where market opportunity lies

Equities v. Cash

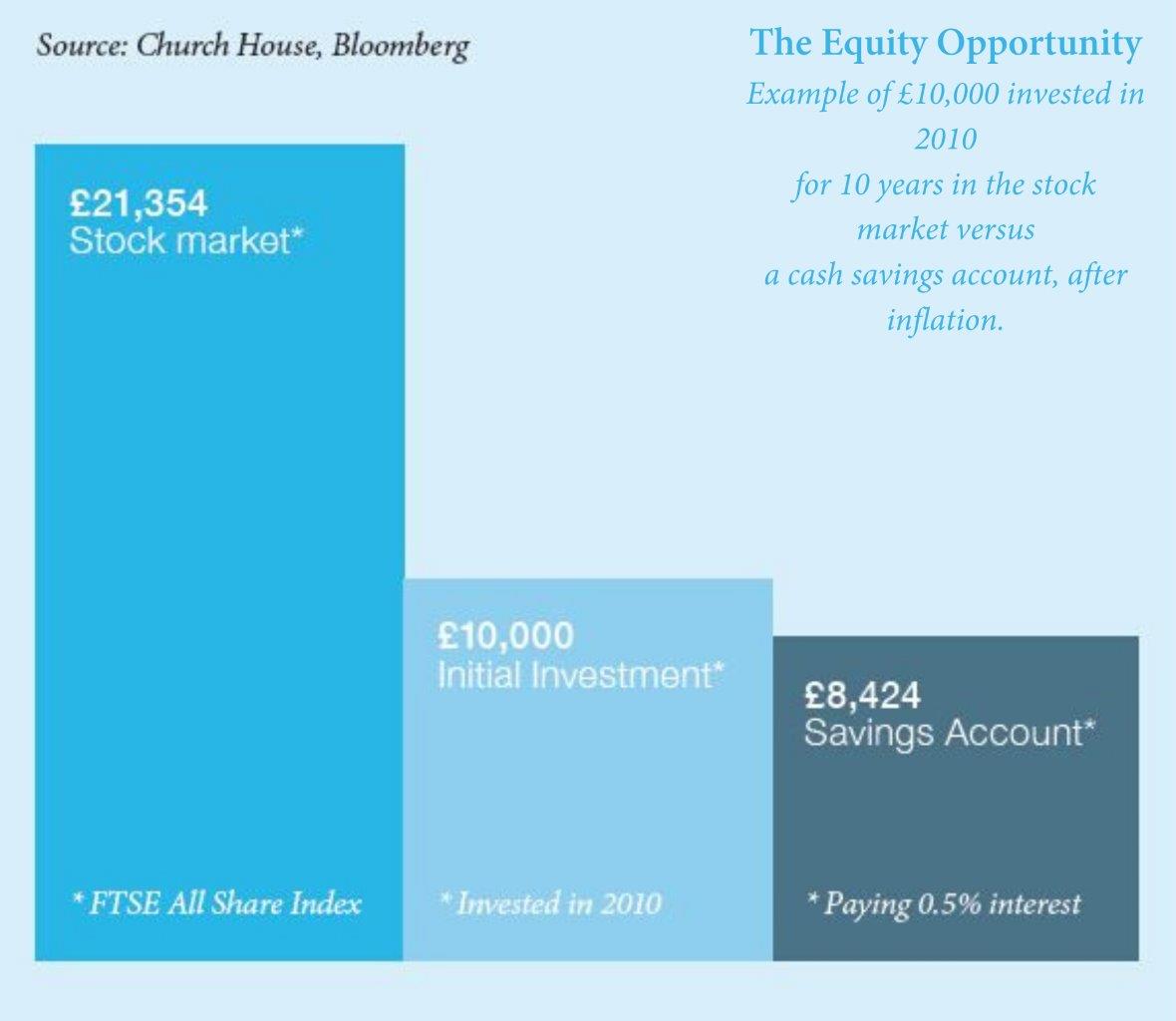

The graph below shows historic returns of cash versus the stock market over the last 10 years. As an example, if you had invested £10,000 in the stock market in January 2010, it would have been worth £21,354 after 10 years. This assumes the re-investment of any dividend income and an adjustment for inflation. In a cash savings account paying an average of 0.5% interest over the same period, and again adjusted for inflation, the same investment would have been worth £8,424 after 10 years. And you thought cash was risk free!

The reduction in value of cash is due to inflation, which has averaged 2% over this 10 year period (as confirmed by the Office of National Statistics in the UK), meaning that if you kept savings in cash, earning the average rate of interest on offer of 0.5%, you were effectively losing 1.5% every year.

Inflation

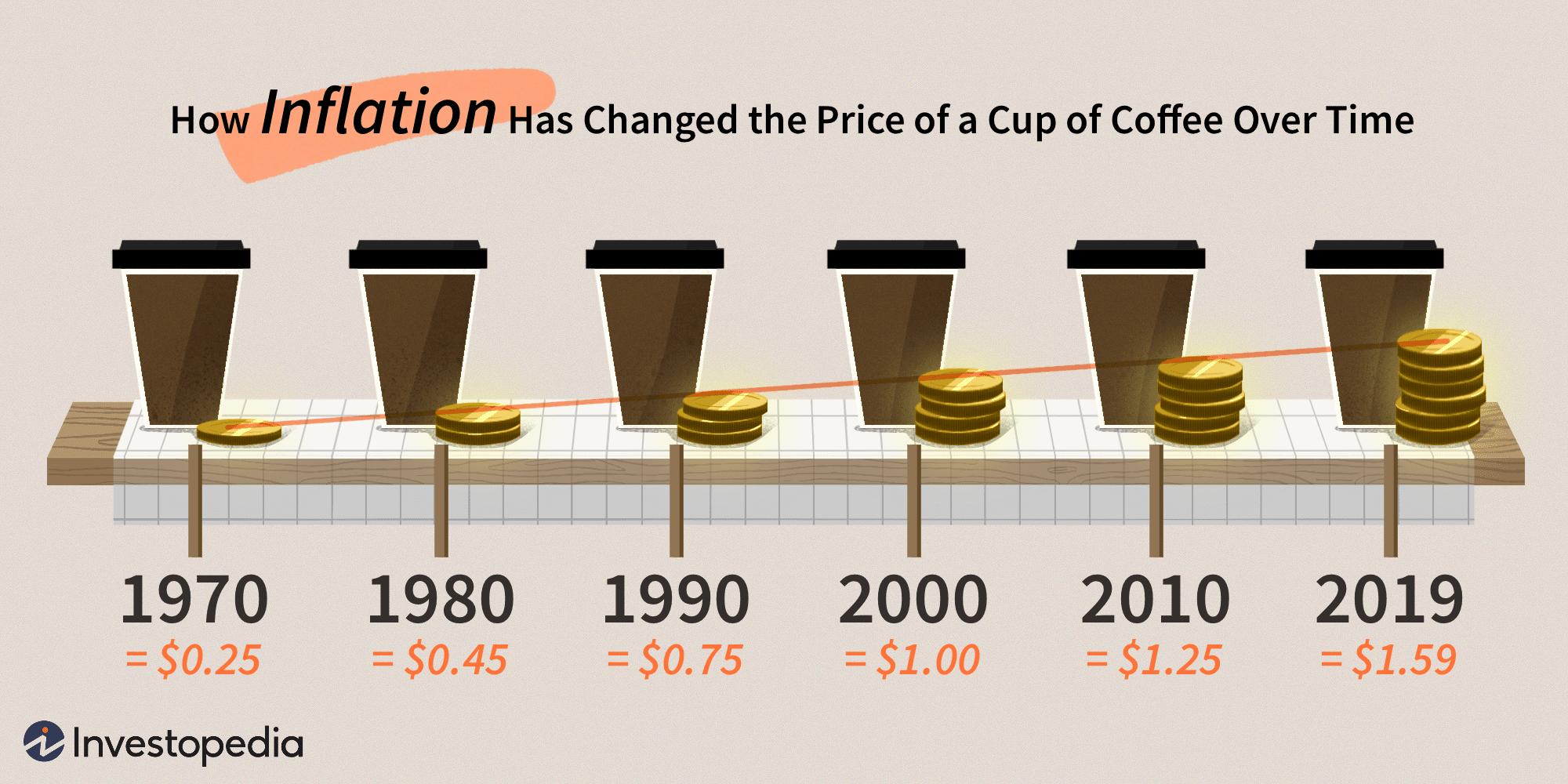

The above chart is a stark reminder of the risk of keeping your hard earned savings in cash. For those who might not be entirely clear about what inflation actually means, it is the rate at which the general level of prices for goods and services rises, thereby eroding the value of the cash you hold.

As an everyday example, we can look at the price of a cup of coffee. The chart is in dollars but of course inflation applies in all currencies. It shows the rise in the price of a cup of coffee over the last 50 years. To buy a coffee from your local coffee shop can now cost you as much as $2.50.

What the example shows is that if you had $100 in the year 2000, you could have bought 100 coffees. The rising price of coffee (i.e. inflation) means that same $100 can now only buy you 40 coffees. A scary thought…

Will inflation keep rising?

It is widely expected that within a year or so post-Covid-19, inflation will start to increase. For a start, although oil prices are currently low, retail fuel and energy prices are bound to pick up with global demand. This affects the cost of living for every household worldwide – heating, fuel, food, etc. The increase in inflation will be seen across a range of goods and services. As stay-at-home restrictions are removed, demand will likely roar back. Families will flock to restaurants, shops, shows, and mini-breaks — anything to leave their homes. We are already seeing this in the UK. Increased demand encourages people to increase their prices. Furthermore, service providers will be keen to recoup the losses of the spring and early summer and some companies will be able to further raise prices if some of their competitors have not made it. This, coupled with record-low interest rates – meaning people prefer to spend rather than save, is very likely to fuel an inflation rise.

So what can you do?

Want to know how to protect your savings from being eaten away by inflation? Consider investing. The primary benefit of investing is to preserve your portfolio’s buying power – you are buying into the companies who are increasing their prices in line with inflation and other market factors, thereby helping to retain the “real” value of your investment, and ideally growing your nest egg. Investing can also lead you to diversify – spreading the risk across a variety of holdings is a time-honoured method of portfolio construction that is as applicable to inflation-fighting strategies as it is to asset-growth strategies.

Diversification

Diversification is an important risk management strategy that mixes a variety of investments within a single portfolio. By holding a mix of distinct asset types, your Investment Manager can limit exposure to any single asset class or risk. Historically, portfolios constructed of different kinds of assets have yielded higher long-term returns and lowered the risk than that of individual holdings or securities. One asset class that investors tend to be “overweight” in is property. You may be lucky enough to already own you own flat or house. If this is the case it will likely make up a large proportion of your overall wealth. To then invest all your savings in property too is putting all your eggs in one basket (or asset class), a risky strategy. If markets turn, we cannot change the direction of the wind, but we can adjust the sails if we have a spread of assets.

Liquidity

When looking to diversify, you should consider if your assets are “liquid”, i.e. can you sell the asset easily and convert it to cash in a short amount of time. Cash is the most liquid asset. However, some investments are easily converted to cash, like shares, gilts and bonds. So they are also referred to as liquid assets. Land, real estate, or buildings are considered the least liquid assets because it could take weeks or months to sell them. The same can be said for assets like wine or cars, since these items take time to sell, and in order to release cash quickly, you may have to accept a price well below what you believe the asset to be worth.

Timing

Equity markets have fallen decisively since January 2020 when Wuhan went into lockdown, but have stabilised during April – July. So is now a good time to invest some cash savings into the market? If you are a long-term investor with a minimum 5-year horizon, and you have cash reserves to cover contingencies, then yes – investing cash that would otherwise be in the bank producing next to zero returns (or a negative return after inflation!) makes good sense at current levels. Why? Because you are buying into today’s market but at 2016 prices. It has been noted that financial markets are the only “shop” in which you hoist up a sign saying “33% off” and everyone rushes for the exits!

In contrast, our investment team were buying selectively throughout March and April, adding to existing holdings at attractively lower levels and initiating positions in companies we had long wanted but previously considered too expensive. In the short-term, markets may well take another tumble on bad news, in which case we will utilise the opportunity to invest more of the cash we continue to hold as dry powder during these uncertain times.

But unless you believe people are going to stop spreading marmite on their toast, why would you not add to a long term holding like Unilever 30% cheaper than you could last year?

If you are interested in exploring investment opportunities, please contact:

Emma Parkes at Church House Investment Management

Email: e.parkes@church-house.co.uk

Telephone: +44 (0) 20 7123 4741

Website: www.ch-investments.co.uk

Instagram: @yachtcrewinvestments

Church House is authorised and regulated by the Financial Conduct Authority

.gif)